The Expense Types help users to create and track expenses.

- To access the Expense Types section, navigate to Accounting → Expense Types.

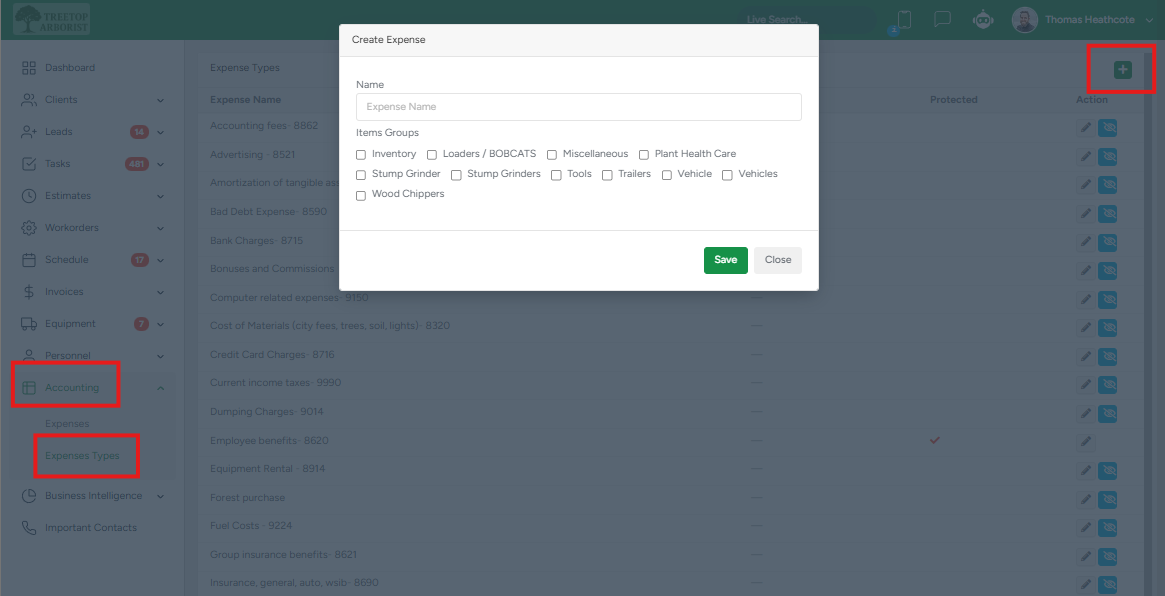

Creating a new Expense Type

- Click on the Plus sign.

- In the pop-up window, fill in the name and pick item groups, and click Save.

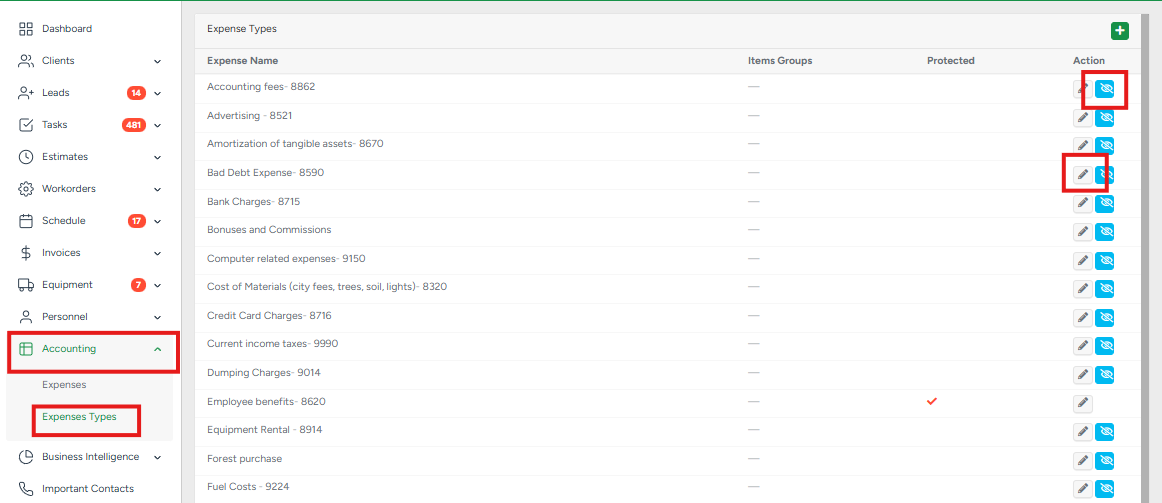

Managing existing Expense Types

In the Expense Types section, you can find all the existing expense types, edit or disable them, and create new ones:

- To edit, click on the Pencil icon.

- To disable/enable the expense type, click on the Eye icon.

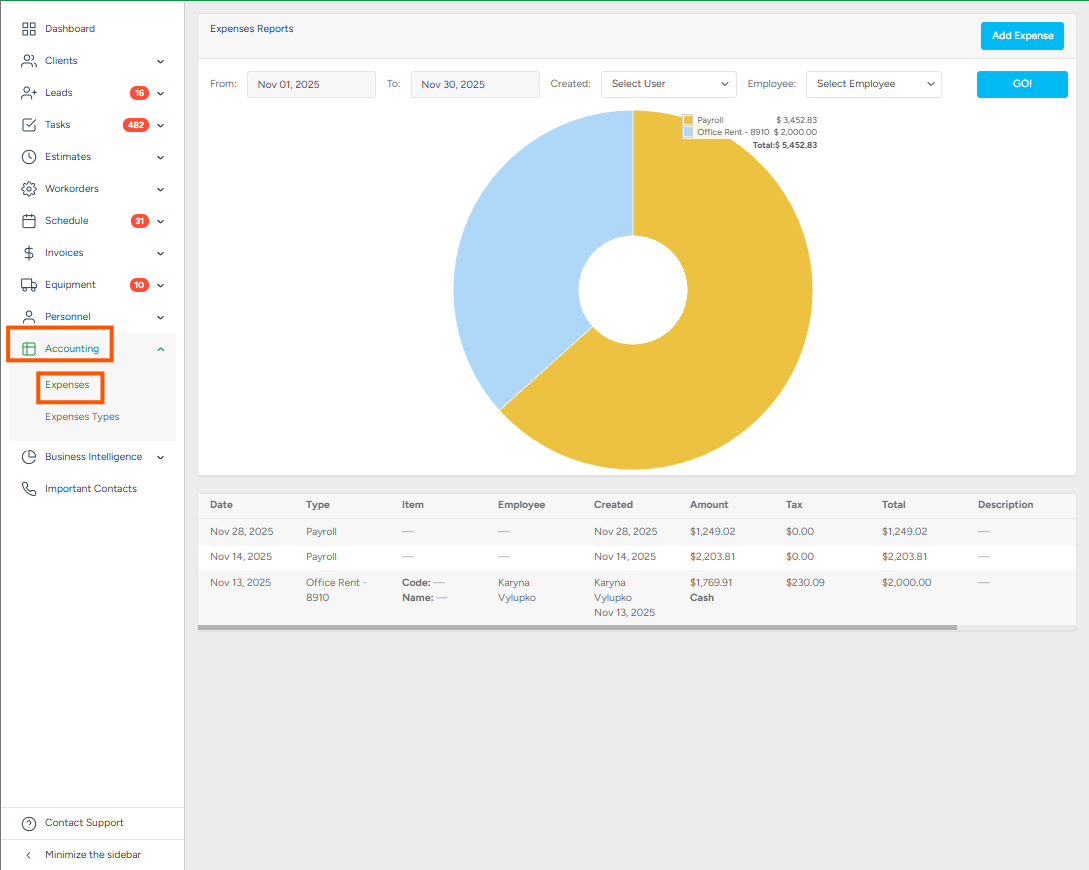

Expenses report

Expense Reports provide a summarized and detailed view of all recorded company expenses within a selected date range. They help track spending, analyze cost distribution, and support accounting or payroll review.

The donut chart shows the proportion of total expenses by category (e.g., Payroll, Office Rent).

Hovering or referring to the legend displays:

Expense Type

Category total

Contribution to overall spending

This helps identify which categories are consuming the most resources.

You can filter by:

Date Range - From (start date) and To (end date). Shows all expenses created within that timeframe.

Created By - Filter expenses by the user who created the record.

Employee - Filter expenses assigned to a specific employee (e.g., reimbursements, payroll, job-related costs).

After selecting your filters, click GO! to refresh the report.

To delete or edit an expense entry, scroll to the right-most tab and click on the pencil icon to edit and the trash bin to delete.

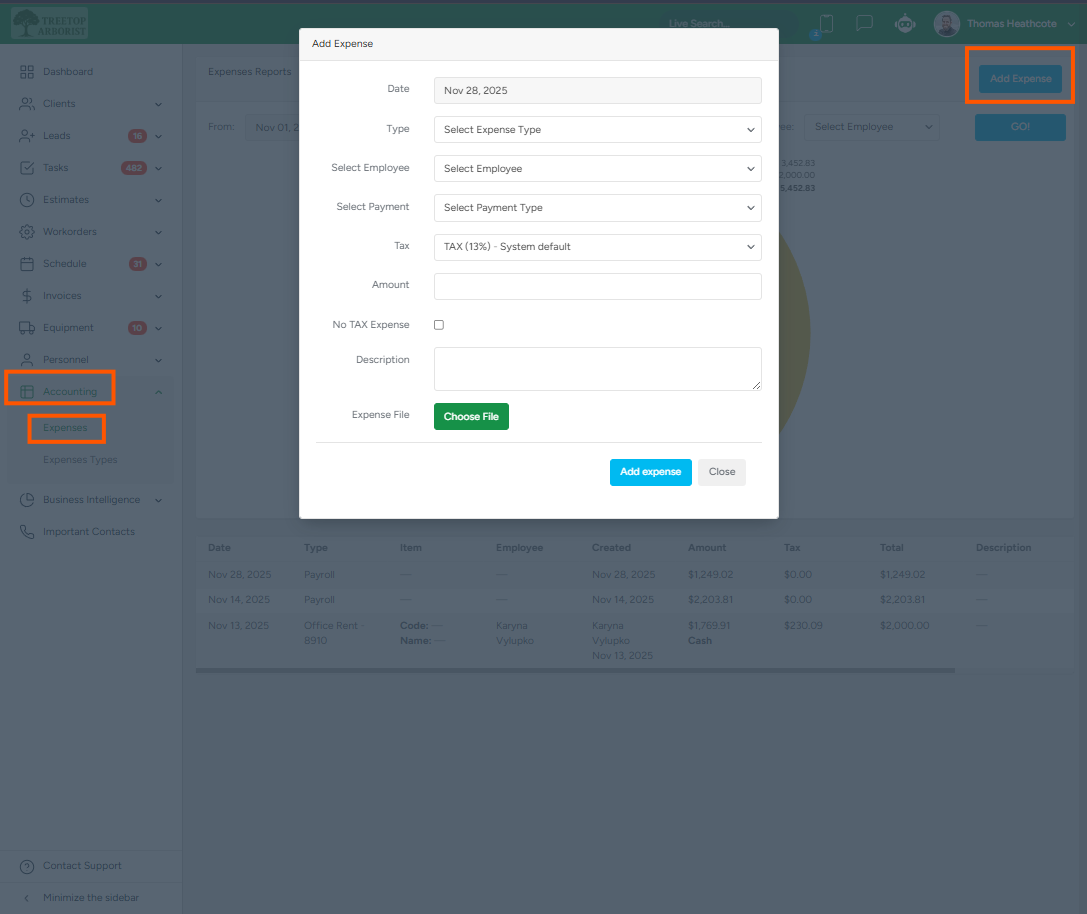

Adding an Expense

Click Add Expense (top-right of the Expenses page). Use this whenever a new company cost, reimbursement, payroll entry, or operational expense needs to be recorded.

- Expense Type - Choose from existing types (e.g., Payroll, Fuel, Office Rent) or custom categories created under Expense Types. Ensures expenses are grouped correctly in reports and charts.

- Select Employee - Links an expense to a specific employee. Used for reimbursements, payroll entries, or purchases tied to a crew member.

- Select Payment type - Records how the expense was paid. Select Cash, Card, Bank Transfer.

- Tax - Applies tax to the expense if applicable. Tick box, for 0.00 or tax-exempt expenses.

- Amount - Records the base cost of the expense. Required for all expenses.

- Description - Provides additional details. Add notes such as purpose, reference numbers, or clarifying information. This is useful for audits and future review.

- Expense file/Attachment - Upload documentation for the expense (receipts, invoices, or proof of payment).