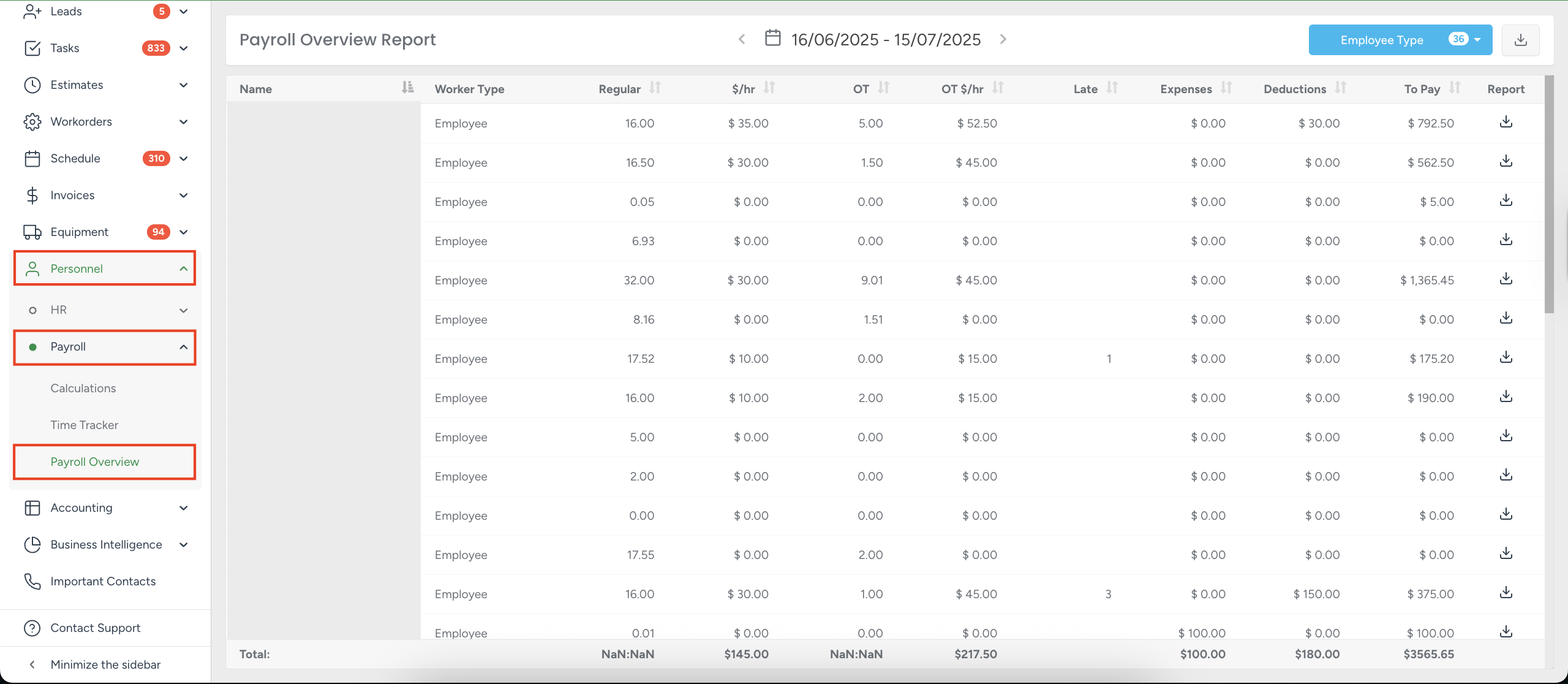

Payroll Overview

The Payroll Overview provides a centralized summary of payroll data for all active employees and subcontractors within the company. This section allows managers and accountants to monitor tracked working hours, overtime, lateness, expenses, deductions, and the final amounts to be paid.

Access

- To open this section, go to Personnel → Payroll → Payroll Overview

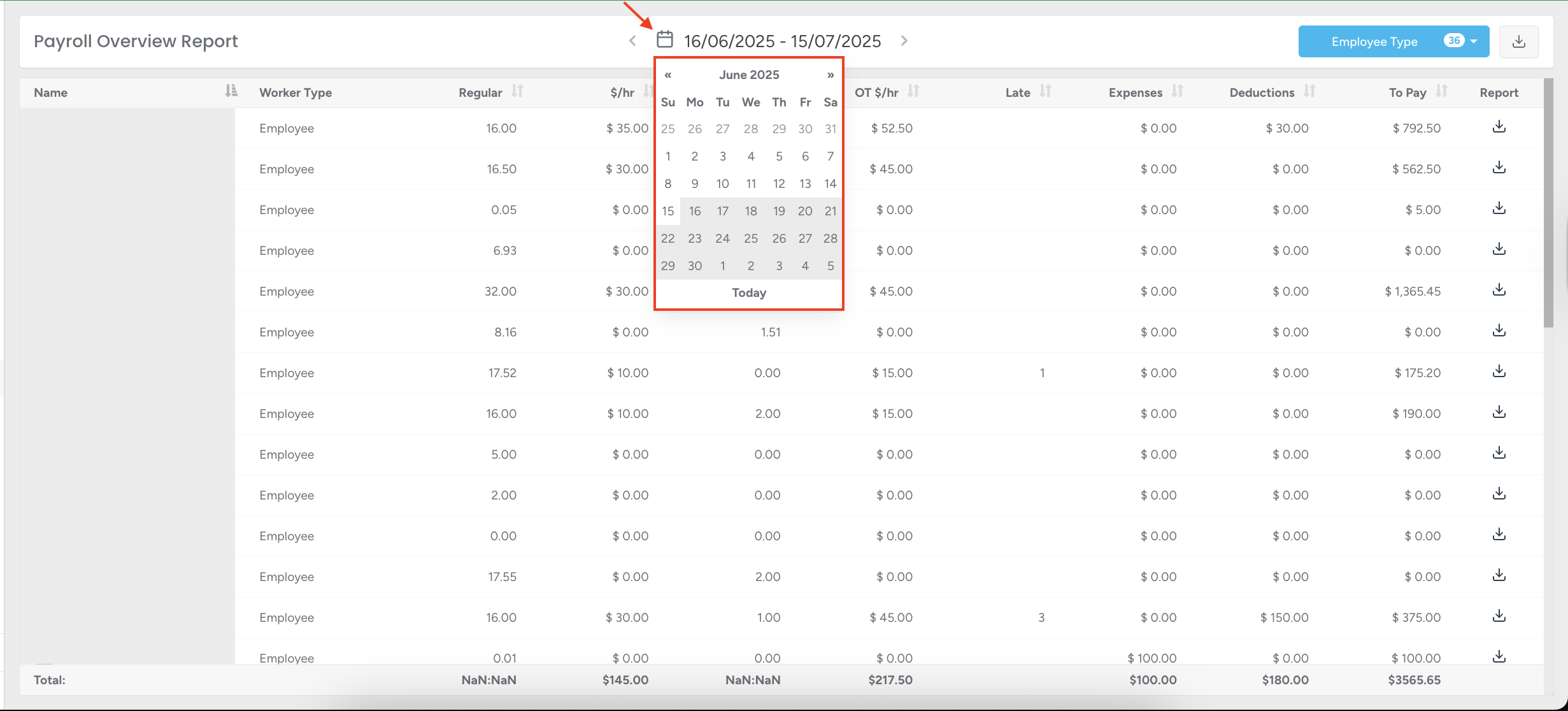

Date Selection

- Click the calendar icon to select the desired date range.

Once the date is chosen, the system automatically adjusts it to the starting day of the payroll iteration period. This setting can be viewed and adjusted in: Personnel → Payroll → Calculations → Settings.

Learn more about Payroll Calculation in this article.

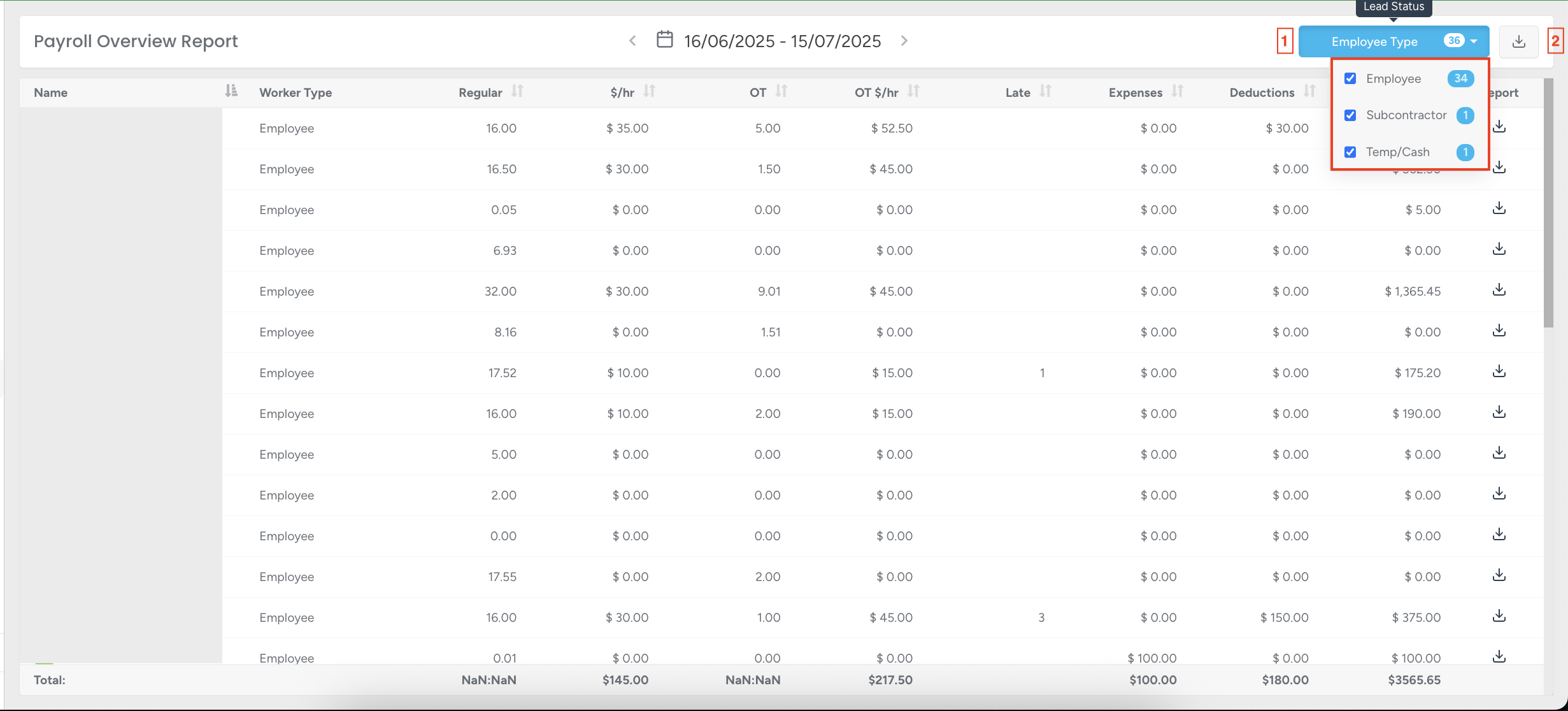

Export and Filter

1 - Filter – choose the worker type: Employee, Subcontractor, Temp/Cash.

2 - Download – available export options:

Payroll Overview (PDF / CSV)

Tracked Time and Commissions (PDF)

Commissions (PDF)

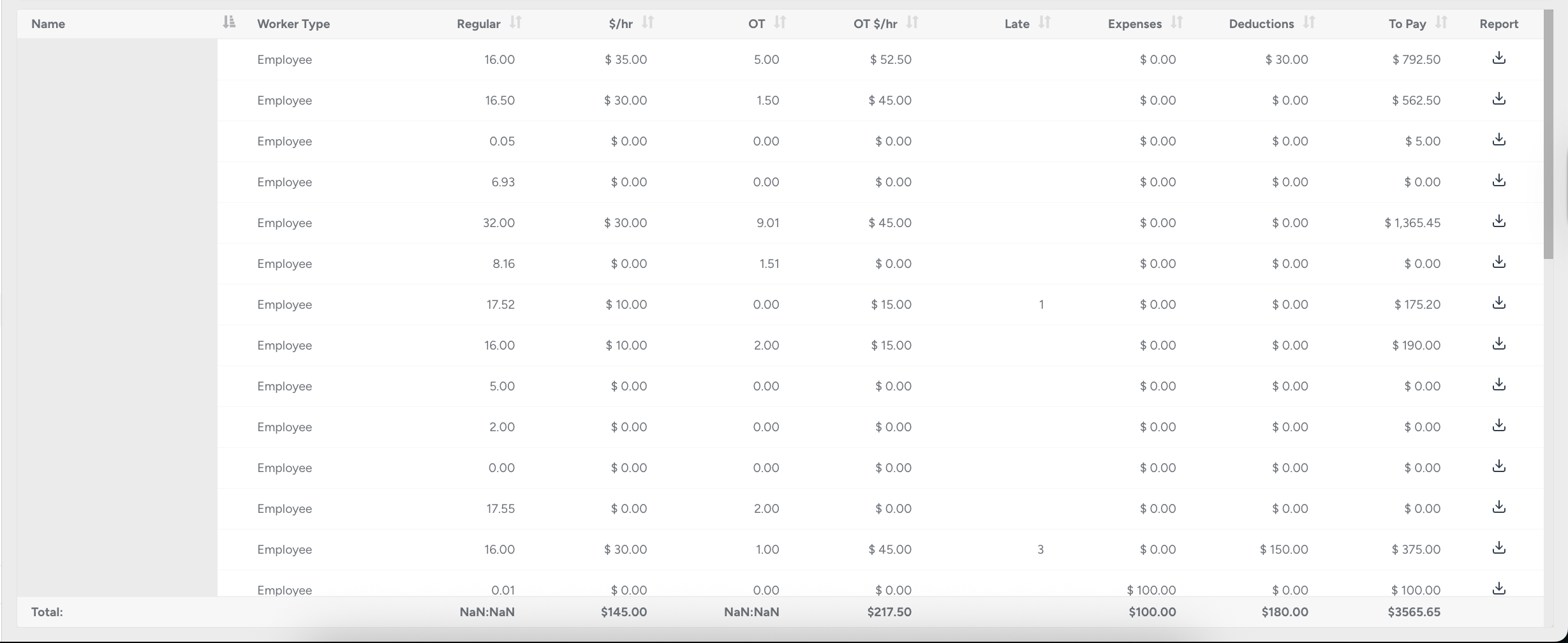

Main Report Columns :

Columns :

Name – employee’s name.

Worker Type – employee, subcontractor, or temp/cash.

Regular – tracked hours during the selected period.

$/hr – hourly rate.

OT – overtime hours.

OT $/hr – overtime pay.

Late – lateness records (if applicable).

Expenses – additional expenses.

Deductions – applied deductions.

To Pay – final amount payable to the employee.

Report – download an individual payroll report for each worker.

Click the arrow icon to change the sorting order. This option is available only in the columns where the arrow is displayed.

Individual report:

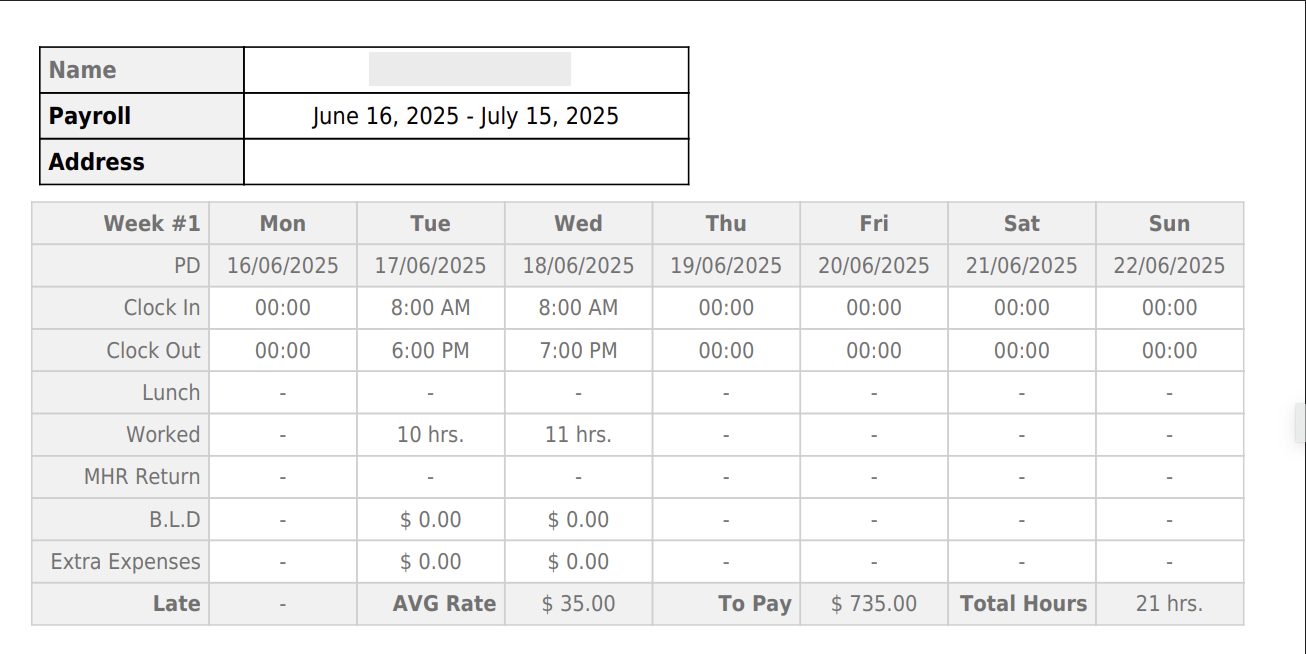

The Individual Report provides a detailed payroll breakdown for a specific employee.

Weekly Breakdown

The first section shows the work details for each week of the payroll period. Information is organized by day and includes:

PD (Payroll Date) – specific date for each day.

Clock In / Clock Out – the exact time when the employee started and finished work.

Lunch – recorded lunch breaks, if any.

Worked – total hours worked on that day.

MHR Return – return time if applicable.

B.L.D. – daily deductions for the employee's breakfast, lunch, and dinner.

Extra Expenses – additional costs related to the employee.

Late – if the employee was late.

At the bottom of the weekly block, the system summarizes:

AVG Rate – the average hourly rate for that week.

To Pay – calculated weekly payment.

Total Hours – total hours worked within that week.

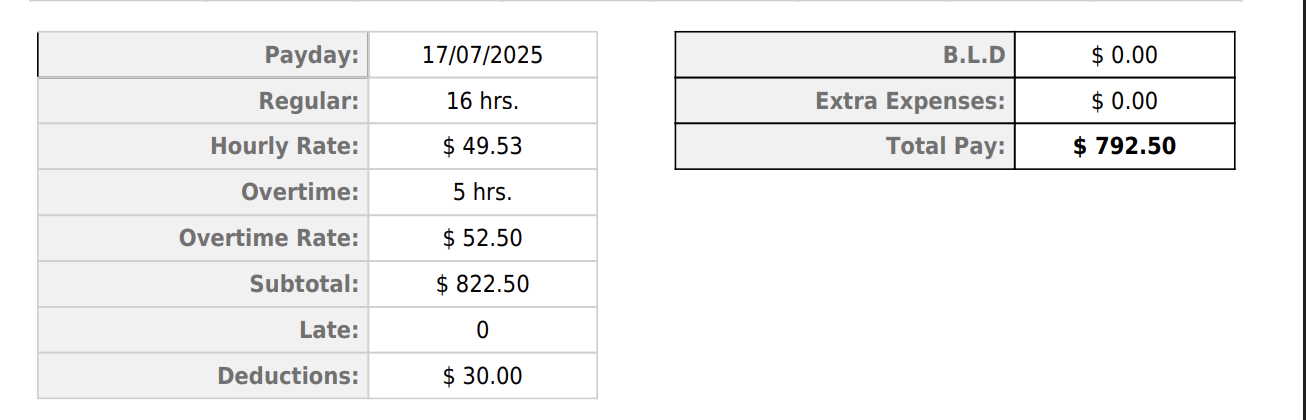

General Payroll Summary

After the weekly breakdown, a general summary of the entire payroll period is provided:

Payday – scheduled payment date.

Regular Hours – total number of standard hours worked.

Hourly Rate – regular pay rate.

Overtime Hours – number of overtime hours recorded.

Overtime Rate – rate applied for overtime hours.

Subtotal – gross pay before deductions.

Late – total number of late records.

Deductions – any payroll deductions applied.

B.L.D. – deductions connected to business/labor details.

Extra Expenses – additional reimbursable expenses.

Total Pay – final amount to be paid to the employee.

Using the Payroll Overview and Individual Payroll Reports, you can quickly access both company-wide payroll data and detailed employee records. This structured approach helps reduce errors, improve financial planning, and ensure every employee or subcontractor is paid correctly and on time.