Invoice & Payment Overview

This submodule offers a comprehensive breakdown of each invoice, including details such as the sales tax report. It allows you to analyze the number of invoices generated and monitor the status of both paid and outstanding invoices within a specific date range.

You’ll also see the total amount for each invoice and the average payment value, which can help you assess whether your pricing aligns with the services provided or needs adjustment.

Additionally, the insights gained from this data can support timely follow-ups with clients regarding pending payments.

- To access the Invoices Reports section, navigate to Business Intelligence → Invoices → Invoices Reports.

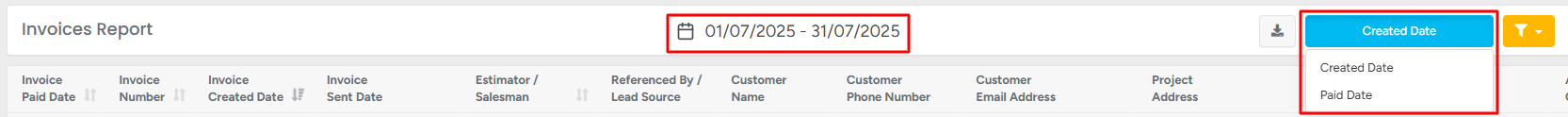

You can view the invoice list based on either the date the invoices were created or the date they were paid.

To filter the list by a specific duration, click the calendar icon and choose the desired date range. You can also sort this by selecting either Created Date or Paid Date from the drop-down menu for a more focused analysis.

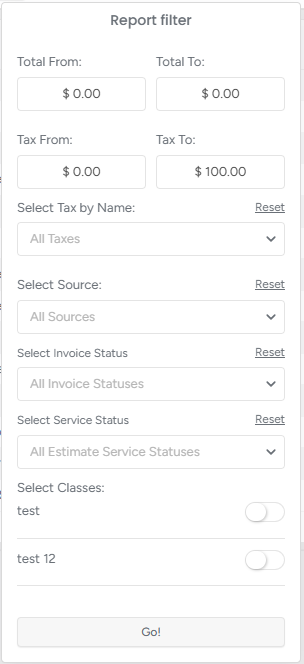

For more advanced filtering options, click the “Report Filter” icon in the top-right corner, complete the necessary fields, and then click Go to apply the filters.

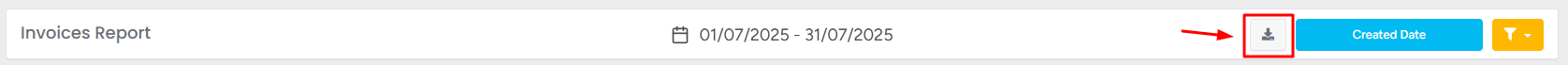

- To download the list in CSV format, simply click the Download button located in the top-right corner.

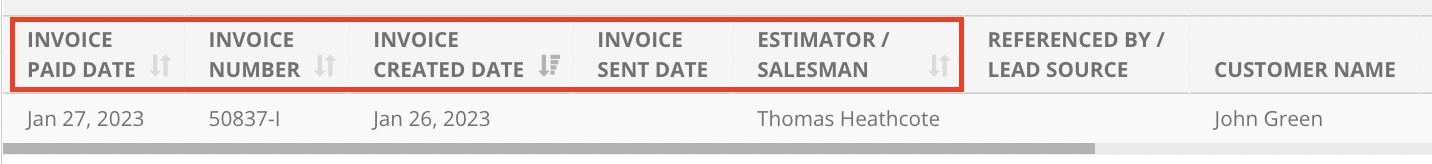

Once you access the required list, you can sort the Invoice Paid Date, Invoice Number, Invoice Created Date, and Estimator/Salesman columns individually by clicking the sort icon next to each column header.

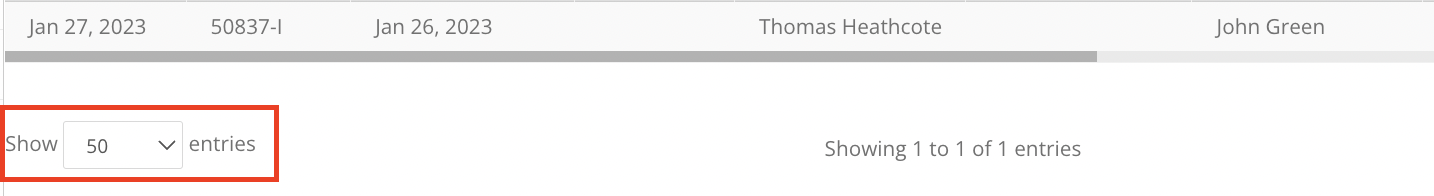

If there are a lot of invoices on the page, you can choose how many entities to see on the page by picking the number from the drop-down list.

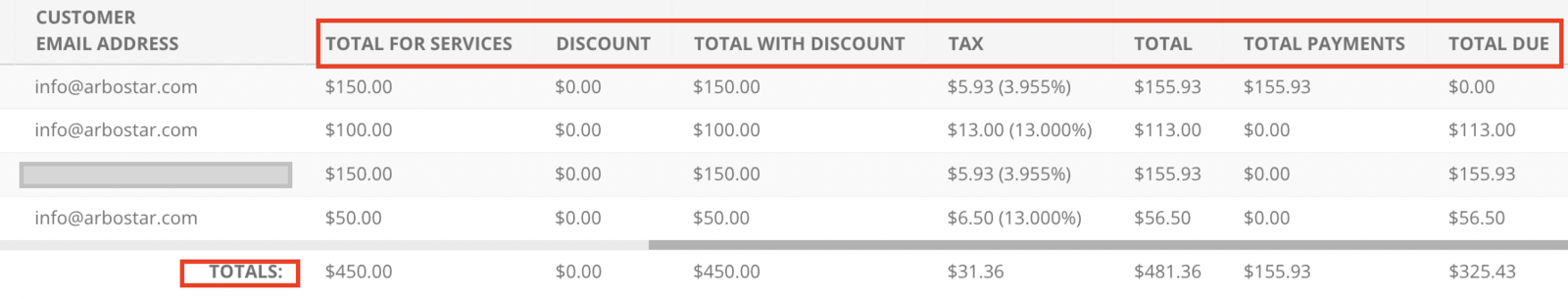

The last 7 columns provide the invoices' sum breakdown:

- In the "TOTAL FOR SERVICES" column, you get the information about the total sum of services for the chosen duration.

- If any of the services were discounted, you can see the discount amount in the "DISCOUNT" column.

- The TOTAL WITH DISCOUNT provides the sum of the services with the discount.

- In the TAX column, you get the information about the tax % for each invoice.

- The TOTAL column provides the sum, including the tax and the discount.

- TOTAL PAYMENTS column shows how much of the invoice has been paid by the client.

- TOTAL DUE column shows the remaining amount of the invoice that needs to be paid.

The Totals under each column provide either the combined sum or the average of the column.